Lost in Nickel Lawsuit at the WTO, Indonesia Forced to Export Raw Nickel?

EU Lawsuit Against Indonesia at the WTO

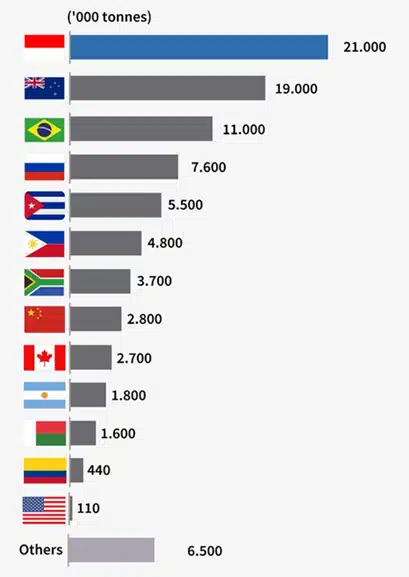

Based on data from the United States Geological Survey (USGS), Indonesia is the world’s largest nickel producer as in 2021 Indonesia has become the world’s highest exporter of raw nickel ore with a total of more than 21 million metric tons, which is equivalent to USD 20 billion or equivalent to 326 Trillion Rupiah. Those resources are useful for companies producing stainless steel, and one that is particularly promising right now is for electric vehicle batteries. However, since decades ago, Indonesia has only exported raw nickel ore.

Source: Market Study of Battery Mineral Resource in Indonesia, National Battery Research Institute.

In 2020, the Government of Indonesia officially stipulated a policy banning the export of raw nickel ore through Regulation of the Minister of Energy and Mineral Resources Number 11 of 2019 concerning the Third Amendment to Regulation of the Minister of Energy and Mineral Resources Number 17 of 2020 concerning Mineral and Coal Mining Business. This policy is the mandate of Article 103 of Law Number 4 of 2009 concerning Mineral and Coal Mining, which states that the processing and refining of mining products of the country must be carried out domestically with the consideration that the export value of the nickel commodity will be more profitable if the raw nickel ore is converted into a more valuable commodity. Regarding this policy, the European Union (EU) as one of the largest nickel importers feels disadvantaged because of the limited access it has to raw nickel ore, and considers Indonesia to have violated WTO provisions i.e., Article XI: 1 General Agreement on Tariffs and trades (GATT) 1994, which reads:

“No prohibitions or restrictions other than duties, taxes or other charges, whether made effective through quotas, import or export licenses or other measures, shall be instituted or maintained by any contracting party on the importation of any product of the territory of any other contracting party or on the exportation or sale for export of any product destined for the territory of any other contracting party.”

Prohibition of restrictions as stipulated in Article XI:1 GATT 1994 is regulated very broadly as this provision stipulates that there is no restriction or prohibition for countries to impose duties, taxes or other charges on imported and exported products. Restrictions that are not allowed in trade at the WTO are in the form of quotas, both for imports and exports. In addition, the EU also accuses Indonesia of carrying out a subsidy scheme through Minister of Finance Regulation Number 76 of 2012 and Minister of Finance Regulation Number 105 of 2016, which is prohibited based on the Subsidy and Countervailing Measures (SCM) Agreement. Regarding the EU’s accusation against Indonesia’s practice of subsidy, Indonesia implements subsidies in the form of import duty exemptions for companies:

- that are modernizing or developing and building new factories; and

- that are located in Industrial Development Zone (WPI) I

Therefore, the EU filed a lawsuit against Indonesia with the World Trade Organization in 2021, in which case the EU was obligated to do the Prima Facie Evidence, which means that to be able to prove its accusation towards Indonesia that Indonesia is inconsistent with its commitment to the WTO provisions, the EU must have strong evidence so the lawsuit can proceed to the trial process until the final decision.

Indonesia Violates WTO Provisions?

The trial was finally held in November 2021, starting with the WTO dispute panel conducting an in-depth study of the EU’s lawsuit and the defense documents submitted by Indonesia. In its lawsuit, the EU considers that Indonesia has violated the WTO provisions to provide broad access for international trade, including access to raw nickel ore. But unfortunately, in November 2022, Indonesia was declared to have lost the lawsuit. In its final report, the dispute panel decided that the Indonesia’s government policy regarding export obligations to process and refine nickel minerals in Indonesia was proven to violate the WTO provisions in Article XI.1 GATT 1994 stating that each WTO member country is prohibited from imposing restrictions other than duties, taxes or other charges.

Indonesia defended that such a policy was necessary due to the limited national nickel reserves and the application of Good Mining Practices. The WTO, however, rejected Indonesia’s initial defense of the EU’s nickel lawsuit by stating that quotas, import or export licenses shall indeed be instituted or maintained by any contracting party, but it couldn’t not be justified by Articles XI.2 (a) and XX (d) of the GATT 1994:

Article XI. 2 (a):

“2. The provisions of paragraph 1 of this Article shall not extend to the following:

(a) Export prohibitions or restrictions temporarily applied to prevent or relieve critical shortages of foodstuffs or other products essential to the exporting contracting party;”

Article XX (d):

“Subject to the requirement that such measures are not applied in a manner which would constitute a means of arbitrary or unjustifiable discrimination between countries where the same conditions prevail, or a disguised restriction on international trade, nothing in this Agreement shall be construed to prevent the adoption or enforcement by any contracting party of measures:

(d) necessary to secure compliance with laws or regulations which are not inconsistent with the provisions of this Agreement, including those relating to customs enforcement, the enforcement of monopolies operated under paragraph 4 of Article II and Article XVII, the protection of patents, trade marks and copyrights, and the prevention of deceptive practices;”

The Government of Indonesia then argued that the panel’s decision did not yet have permanent legal force, so there was still an opportunity for Indonesia to file an appeal and there was no need to change the regulation or even revoked the policies before the disputed decision was adopted by the Dispute Settlement Body (DSB). Therefore, on December 12, 2022, the government of Indonesia filed an appeal against the WTO panel’s ruling, which stated that the policy of the ban on nickel ore exports and downstream was considered to have violated WTO provisions.

Read More: Carbon Offset: The Way To Achive Indonesia’s NDC Target In 2030

Nickel Downstream After Indonesia’s Defeat at the WTO

In the continuous effort to increase added values of Indonesia’s domestic raw materials, the Government of Indonesia committed to focusing on developing downstream commodities because the government’s policy regarding the ban on nickel exports is considered successful as can be seen through the increase in the total added value of nickel commodities in 2022 with a total amount of US$ 12 Billion or the equivalent of 188 Trillion Rupiah.

Regarding this matter, as a follow-up policy, the government will also impose a ban on bauxite ore export and further develop the domestic bauxite processing and refining industry starting in June 2023. The coordinating Ministry for Maritime and Investments Affairs also estimates that the added value of nickel commodities will reach US$ 38 Billion or the equivalent of Rp 592.2 Trillion. The number of nickel processing plants will also be increased, which is estimated to reach 43 nickel processing plants this year, and this, of course, gives positive impacts in increasing employment opportunities.

The International Energy Agency (IEA) in the Southeast Asia Energy Outlook 2022 predicts that demand for nickel will grow rapidly by up to 20 times during the period of 2020 to 2040. Currently, the global campaign to reduce fossil fuel consumption has increased the demand for electric vehicles (EVs). As nickel is the key component of electric vehicles, which accounts for 25-40% of the cost of EVs and determines its performance, the abundance of domestic nickel resources, nickel downstream and nickel processing plants in Indonesia are very promising econonic factors in this energy transition.

Mining and Smelting Companies to adhere to the Mineral Benchmark Price (HPM) Set After The Nickel Export Ban Policy.

The Indonesian Government has set the Mineral Benchmark Price (HPM) through the Minister of Energy and Mineral Resources Regulation Number 07 of 2017 concerning Procedures for Setting Standard Prices for Metal and Coal Mineral, as amended several times and most recently by the Minister of Energy and Mineral Resources Regulation Number 11 of 2020. The following are the Mineral Reference Price (HMA) dan Mineral Benchmark Price (HPM) for nickel as per February 2023:

source: nikel.co.id

These provisions for the Nickel HMA and Nickel HPM February 2023 are guidelines for nickel mining companies and nickel smelters in conducting sale and purchase transactions of nickel ore from NI 1.6% to 2.0%. Nickel HMA is determined based on the average price of nickel metal in Cash Seller and Settlement published by the London Metal Exchange (LME), the average price of which is taken from the 20th of two months before the HPM period to the 19th of one month before the HPM period.

On February 10, 2023, the Ministry of Energy and Mineral Resources issued a Decree of the Minister of Energy and Mineral Resources Number: 27.K/MB.01/MEM.B/2023 concerning Metal Mineral Prices Reference and Coal Prices Reference for February 2023, in which Nickel Mineral Reference Price (HMA) is set at US $ 28,444.50 Dry Metric Ton (DMT), which is US $ 961.88 higher compared to the Nickel HMA January 2023, amounting to US $ 27,482.62 DMT.

The government in setting the Mineral Benchmark Price (HPM) aims to create a fair, competitive, and transparent trading system in the minerals and coal subsector for both nickel mining companies and nickel smelters. The government believes the improvement of HPM regulation through MEMR 11/2020 will create a conducive investment climate for smelters and miners as well as to maintain the competitiveness of the downstream industry in Indonesia.

Not only has a task force been formed to ensure compliance with the HPM, but the evaluation is also carried out routinely to impose sanctions on business actors both miners and smelters who are proven to have violated the rules that have been set and agreed upon. Regarding compliance, Holders of Nickel Commodity Mining Business License and Nickel Commodity Industrial Business License (Facilities for Processing and/or Purifying of Nickel Commodities) must refer to Nickel HPM in the sale and purchase transaction of raw nickel ore. Sanctions can be imposed on those who do not comply with regulations related to HPM as stated in Article 12 paragraph (2) of the Minister of Energy and Mineral Resources Regulation Number 11 of 2020, which states:

(2) Administrative sanctions as referred to in paragraph (1) are in the form of:

- Written warning;

- Temporary termination of part or all mining business activities, and/or

- Revocation of Production Operation IUP or Production Operation IUPK

Strategiesadto Anticipate defeat in Appeal

The government should pay attention to the anticipation of defeat in the appeal to the WTO regarding this nickel export ban. The profits that Indonesia has gained through nickel downstreaming should not turn into losses because it is used as compensation for Indonesia’s defeat at the WTO. Quoting from the Research Director of SEEBI (the Socio-Economic & Educational Business Institute) Jakarta, a Member of Focus Group on State Fiscal and Financial Affairs of Central PP-ISEI, Haryo Kuncoro, several strategies to anticipate defeat in appeal can be developed through policies set by the government, as follow:

- Imposition of higher export duty on exported raw nickel ore, and lower export duty on exported processed nickel.

- Foreign importers are required to have processing nickel plants in Indonesia, creating partnerships with domestic industrialists.

- Accelerate the downstream nickel ecosystem before the expiration of the appeal period.

Indonesia’s move to ban nickel ore exports is not a risk-free step. Indonesia’s persistence will only bring benefits if it is balanced with careful consideration and risk management from the Indonesian government on tax issues, ease of investment, and purchase price of raw nickel ore from mining companies to domestic smelters. A synergy is needed in cooperation to overcome risks and take advantage of potential benefits related to Indonesia’s nickel export ban policy.

***

About ADCO Law:

ADCO Law is a firm that offers clients a wide range of integrated legal services, including in commercial transactions and corporate disputes in a variety of industry sectors. Over the course of more than a decade, we have grown to understand our client’s industry and business as well as the regulatory aspect. In dealing with business dynamics, we provide comprehensive solid legal advice and solutions to minimize legal and business risks.

From Upstream to Downstream, We Understand Your Industry. In complex transactions as well as in certain cases, we are actively engaged with financial, tax, and environmental specialists, accountants, and law firms from various jurisdictions to give added value to our clients. Having strong relationships with Government agencies, regulators, associations, and industry stakeholders ensures that our firm has a holistic view of legal matters.

ADCO Law is a Proud Member of the Alliott Global Alliance (AGA) in Indonesia. Founded in 1979, AGA is one of the largest and fastest-growing global multidisciplinary alliances, with 215 member firms in 95 countries.

As a law firm, we also believe in regeneration. To stay abreast of business changes and stay relevant, our formation of lawyers is comprised of the top graduates from Indonesian and international law schools.

For further details, please contact:

Alvin Mediadi, Business Development Manager, Indonesia

+628 57 234 89625, [email protected]

Maulidza Oemar, Public Relations, Indonesia

+62 877-7528-1922, [email protected]